YES PAY

Description of YES PAY

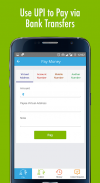

BHIM YES PAY is a smart payment application enabling you to transfer funds, pay bills, recharge mobile /DTH and purchase vouchers using UPI and Digital Wallet. It also provides users to shop online using a Virtual Card and also pay at online/physical merchants using UPI and Bharat QR.

To register for BHIM YES PAY one need not be a YES BANK customer.

Key Features –

Unified Payment Interface (UPI) - Register for UPI and manage your virtual address. You can Pay, Collect money, View Account Balance, Latest transactions, Set MPIN, Change MPIN and much more.

Virtual Card - All YES PAY users get a free virtual card which can be used to pay at E-commerce websites.

BharatQR – You can use your wallet balance and linked YES BANK cards to pay at outlets / terminals featuring BharatQR for payments.

YES BANK Credit Cards - You can link and manage your Credit Card within YES PAY, including card bill payment using YES Bank account and UPI linked accounts, view statement, block card and more!

YES BANK Gift Card Management – View statements/transactions history, make e-commerce purchases, manage card security

YES Bank Multi-currency Travel Card Management – Now manage your daily limits and preferences for ATM, POS, Contactless and E-commerce transactions

Load Money – Money can be loaded conveniently using YES BANK or any other Bank Account through Debit / Credit Card or Internet Banking. Users can also load money by their UPI linked bank accounts.

Send and Receive Money – Instant and secure fund transfer to other YES PAY users or Bank Accounts. Option to request money from friends/contacts.

Prepaid Mobile Recharge - Recharge your prepaid mobile with ease of India’s leading telecom service providers.